Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Future Generali India Life Insurance Company Limited is now Generali Central Life Insurance Company Limited. Generali Central Life Insurance Company Limited – A joint venture between Generali – one of the world’s leading insurers and Central Bank of India, India’s finest nationalised bank.

Financial Planning for Child Future: A Practical Guide for Parents

8 mins

8 mins 0

0To know how early planning can reduce future stress and costs, read on…

The first school admission form costs a few thousand rupees, but the annual school fees run into lakhs.

The first extracurricular activity seems affordable, but when coaching, classes, and materials add up, the number looks very different.

Most parents barely notice these expenses when their child is young. The problem surfaces years later, when annual school fees cross six figures, competitive exams demand specialised coaching, and college costs bear little resemblance to what parents had imagined.

This is where panic begins.

Financial planning for child future is not about predicting every expense perfectly. It is about accepting one uncomfortable truth early: child-related costs are unavoidable, and they rise faster than most incomes.

In simple terms, financial planning for a child’s future means setting aside money today for expenses that will definitely arrive tomorrow. Education, healthcare, lifestyle needs, skill development, and financial support during early adulthood are not optional milestones. They are part of modern parenting.

Many parents assume their existing savings are enough. Others believe a strong income will handle future needs. Both assumptions usually fail because timing matters more than intent.

Early planning matters because it gives you time. Time allows small, regular investments to grow and absorb inflation. Delay removes that advantage and pushes families towards loans and last-minute decisions.

With education costs rising steadily and children remaining financially dependent for longer, planning early is no longer a good habit. It is basic financial hygiene.

This guide breaks down financial planning for child future in simple terms, without finance jargon, and shows how new parents can start early and avoid last-minute stress.

What Is Financial Planning for Child Future and Why Is It Important?

Financial planning for child future is goal-based planning built specifically around your child’s financial needs. It is not an extension of your household savings, and it is not something to be handled later when expenses start rising.

At its core, it means setting aside money deliberately for milestones your child will reach, regardless of what else is happening in your life. These are expenses you cannot postpone, negotiate, or avoid.

Financial planning for child’s future begins with schooling. Annual fees, books, uniforms, extracurricular activities, and coaching costs increase steadily every year. What feels manageable in the early years often becomes a significant and recurring expense over time.

Higher education is usually the next largest financial commitment. Professional degrees, private universities, and overseas education can cost anywhere from a few lakhs to several crores by the time your child is ready. These costs tend to rise faster than most parents expect.

Skill development adds another layer throughout the two stages from sports training and creative courses to certifications, and specialised programmes. These are increasingly becoming important as they influence career outcomes and are rarely inexpensive. Many parents also plan to support their child during early adulthood, whether through higher studies, relocation, or career transitions.

Inflation adds its own weight to the equation. Education inflation consistently outpaces general inflation. A course that costs ₹10 lakh today may cost ₹25–30 lakh in 15 years. Saving today’s amount without accounting for future cost increases creates a misleading sense of preparedness.

This is why general savings are not enough. General savings are flexible by design, which makes them vulnerable to lifestyle spending, emergencies, and short-term priorities. Without a separate plan, funds get diverted, goals are underestimated, and decisions are made reactively instead of intentionally.

The impact of timing is clear. Parents who start planning early, even with small amounts, build readiness over time. Those who delay often rely on last-minute loans when costs escalate. The difference is not income. It is timing.

Financial Planning for New Parents: Where and How to Start?

For new parents, financial planning often feels overwhelming because everything seems urgent at once. Expenses increase, priorities shift, and there is rarely a clear starting point. The key is sequencing. Do the basics first, then build forward.

First Steps After Your Child Is Born

The first step is to reassess your household budget. Child-related expenses change monthly cash flow in small but steady ways. Adjust discretionary spending early instead of reacting later when pressure builds.

An emergency fund becomes critical once you have a child. Emergencies are no longer optional or predictable. Aim to build at least six months of expenses. This buffer ensures that unexpected costs do not disrupt long-term savings meant for your child.

Health insurance needs immediate attention. Your child should be covered from day one, and existing coverage for parents should be reviewed as well. Medical emergencies should not force you to pause or withdraw from education-focused savings.

It is also important to start goal-based saving early. You do not need large amounts to begin. Small, regular contributions are enough. Waiting for extra money rarely works because expenses tend to rise in parallel with income.

How to Set Financial Goals for Your Child

Start by separating short-term and long-term goals. Short-term goals include school fees and early activities. Long-term goals typically revolve around higher education and early career support.

When estimating future costs, avoid overcomplicating the process. You do not need perfect projections. Rough estimates adjusted for inflation are sufficient to start planning effectively.

Goals should be reviewed periodically. As your child grows, interests change and costs evolve. Financial planning is not a one-time exercise but an ongoing process that needs recalibration.

Common Mistakes New Parents Make

Many parents delay planning because early expenses seem manageable. This false comfort leads to rushed decisions later.

Another common mistake is mixing child-related savings with general savings, which makes those funds vulnerable to everyday spending. Over-reliance on fixed deposits without considering long-term growth limits future preparedness. Ignoring inflation entirely is perhaps the most damaging error, as it quietly erodes purchasing power over time.

These mistakes compound gradually and usually become visible only when the cost of correction is high.

Best Investment Options for Financial Planning for Child’s Future

There is no single investment that fits every parent. The right option depends on how early you start, how much risk you are comfortable with, and how regularly you can save. For most parents, financial planning for a child’s future works best when different options are used together.

Investment Options Explained Simply

Child plans (insurance-linked)

Child plans combine long-term savings with insurance protection. Their key benefit is continuity. Even if something happens to the earning parent, the child’s financial goals remain protected. These plans suit parents who want a structured, long-term approach.

Mutual funds (SIP-based)

Mutual funds help grow money over time and are suitable for long-term goals like higher education. Since they are linked to the market, returns can fluctuate in the short term. However, when investments are spread over many years, they tend to deliver better growth than traditional savings.

Fixed deposits and PPF

Fixed deposits and PPF offer safety and predictable returns. They work well for short-term needs or when you want to protect money that will be used soon. On their own, however, they may not keep up with rising education costs.

Sukanya Samriddhi (where applicable)

Sukanya Samriddhi is a government-backed savings scheme for girl children. It has a long lock-in period and is designed for long-term use. It works best when combined with other investments rather than used alone.

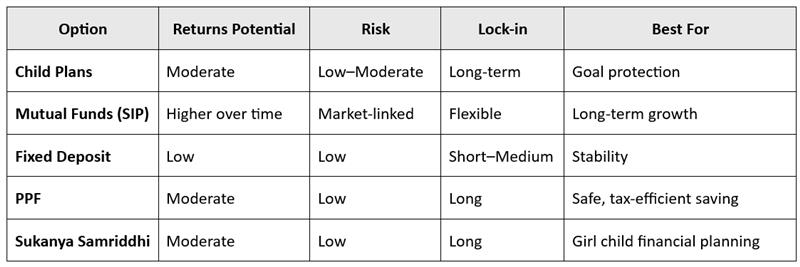

Investment Comparison Table

How to Choose the Right Mix

If your child is below five years old, you have time on your side. A higher focus on growth-oriented options allows your savings to build steadily.

When your child is between five and ten years old, balance becomes important. Continue investing for growth but start reducing risk gradually.

Once your child is above ten, the focus should move towards safety. At this stage, protecting what you have already built matters more than aggressive growth.

Using a mix of investments helps spread risk and keeps your child’s future plans on track.

Financial Planning for Child Education: How Much and How Early?

Education is the single largest expense most parents’ underestimate. In the early years, costs appear manageable and predictable. The real financial pressure arrives much later, when choices around institutions, courses, and locations begin to multiply.

Education costs in India vary widely. Government institutions remain relatively affordable, but professional degrees, private colleges, and international education can increase costs dramatically. Inflation pushes these numbers higher every year. A course that costs ₹15 lakh today could easily cost ₹40 lakh or more in 18 years. Planning based on current costs alone creates a shortfall that becomes visible only when it is too late to correct comfortably.

This is why timing matters as much as the amount you save. The earlier you start, the less you need to invest each month. Starting late compresses the timeline and places far greater pressure on monthly cash flow, often forcing families to compromise on choices or rely on loans.

A simple comparison makes this clear. Investing ₹5,000 per month for 18 years with steady long-term growth can result in a significantly higher corpus than investing ₹15,000 per month for just 10 years. The difference is not the effort. It is the time available for compounding.

Financial planning for child education works best when it begins early, grows gradually, and is reviewed periodically. The math is straightforward. Time does the heavy lifting.

Role of Insurance in Financial Planning for Child

Savings alone do not fully protect a child’s future. While savings help build funds over time, they do not address the risk of income loss. Insurance fills this gap by ensuring that a child’s financial plans remain intact even if circumstances change.

Why Term Insurance Is Critical for Parents

Term insurance is designed to replace income if something happens to the earning parent. Without this protection, long-term plans can collapse instantly, regardless of how carefully savings have been built.

Many parents assume that child plans are sufficient on their own. They are not. Child plans support goal-based saving, but they cannot replace adequate life cover. Term insurance provides the foundation on which all child-related financial planning rests.

How Insurance Secures the Child’s Goals

Insurance ensures continuity. Education goals remain funded even if income stops unexpectedly. Long-term plans are not abandoned midway due to financial strain. Children are not forced to compromise on education or opportunities because of circumstances beyond their control.

By addressing risk directly, insurance converts financial planning for a child from an intention into a safeguard. It reduces uncertainty and provides structure to long-term commitments.

Why Early Financial Planning for Child’s Future Makes a Huge Difference

Early financial planning for child future is not about starting with large amounts. It is about starting on time. Time changes outcomes in ways income alone cannot.

Power of Time Over Money

Small, consistent investments made early often outperform larger contributions made later. When you start early, your savings have more time to grow and absorb market fluctuations and inflation. This reduces pressure on monthly cash flow and allows greater flexibility as your child’s needs evolve.

Reduces Dependency on Loans

Planned savings significantly reduce the need for education loans. When parents rely on borrowing at the last moment, repayments can stretch well into the child’s working years, limiting financial freedom for both generations. Early planning helps avoid this cycle by building readiness in advance.

Peace of Mind for Parents

Early planning brings predictability. Parents have clarity on what they are working towards and how prepared they are at each stage. Decisions become proactive instead of reactive, and financial stress is reduced over time.

This sense of control is the real benefit of financial planning for child future. Start planning early to understand how much you need and the options available because a structured plan today can make your child’s future goals easier to manage tomorrow.

Comp-January-2026_4516

Suggested Plans

Related Posts

We foster an inclusive workplace where diverse perspectives thrive, and every individual feels valued, respected, and empowered.

Planning for Childs Future

Cost of Raising a Child in India: A Realistic Breakdown for Parents

8 mins

0

Posted on: Feb 03, 2026

Planning for Childs Future

Mistakes to Avoid While Planning for Your Child’s Future

8 mins

0

Posted on: Feb 02, 2026

Planning for Childs Future

Child education plan: a comprehensive guide for young parents

4 mins

4.8K

Posted on: Jul 21, 2025

Get Expert Advice from Your Trusted Life Insurance Partner!

Have questions? Get help and reliable support from experts at Generali Central India Life Insurance.

Explore Knowledge Center

From insurance basics to wealth-building strategies — everything you need, in one place.

Got Questions? We’ve Got Answers!

Here are answers to some of the questions you might have.

Life insurance is a financial safety net that supports your loved ones in your absence. If something happens to you, it provides them with funds to help cover everyday expenses, repay debts, and achieve future goals. It gives you peace of mind, knowing your family’s financial future is secure— no matter what.

The right plan depends on your needs.

Start by assessing your life stage, financial goals, and the needs of your family. Consider factors like your income, outstanding loans, future expenses and goals (like children’s education, foreign travel, study abroad), and desired coverage amount. We offer a wide range of plans that cover multiple goals and budgets. To get a better idea and make a confident choice consult with a financial advisor or call us on 1800 102 2355.

A good rule of thumb is to aim for coverage that's 10–15 times your annual income. Consider your family’s living expenses, outstanding loans, children’s education, and long-term goals. The right amount ensures your loved ones can maintain their lifestyle and meet future needs— even in your absence.

We would love to help you choose and buy the right policy for your needs. Call our toll-free number 1800 102 2355 or drop us an email at care@generalicentral.com.

Reach out to us in any way that you prefer, and our team of experts will soon get back to you!

Disclaimers

Understand your policy better with key details and insights into our Generali Central Life Insurance.

This Product is not available for online sale. Life Coverage is included in this Product. For detailed information on this plan including risk factors, exclusions, terms and conditions etc., please refer to the product brochure and consult your advisor, or, visit our website before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. If you have any request, grievance, complaint or feedback, you may reach out to us at care@generalicentral.com For further details please access the link: www.generalicentrallife.com/customer-service/grievance-redressal-procedure.

Subscribe to get our best content in your inbox

Subscribe to our newsletter and stay updated.